3 Smarter Ways To Spend Your Tax Return

We’ve all been there. You’ve recently completed your personal tax return as a small business owner and been blessed with a healthy return of unexpected cash. Suddenly, what you then do with that money often becomes an internal battle.

To spend or to save? Be fun or financially responsible? Buy that new TV or save for a rainy day?

However, there ARE ways to spend the money that can be both smart and rewarding. Here are the top ways to spend your tax return as a small business owner.

Invest in yourself

You may not realise it, but as a small business owner you are already an expert at investing in yourself.

That is, starting your own business is one of the most powerful forms of self-investment. But, believing in your own ideas and investing time and money into a business venture is just one form of self-investment.

There are a few other key avenues through which you could continue to invest in yourself with your tax return.

You could:

- Invest in your skills and capabilities by enrolling in online or in-person educational classes. Learning a new skill or expanding your knowledge can be very rewarding and potentially improve your business.

- Invest in your mental health through therapy or relaxation. Even investing in something as simple as a meditation app on your phone could be hugely beneficial.

- Invest in your physical health by paying for exercise classes, a healthy eating service or a diet program. As a busy small business owner, sometimes looking after our physical health stops being a priority. Being physically healthy can give you more energy throughout the day to spend doing what you love.

Regardless of which type of self-investment you choose, investing in yourself is one of the ways to spend your tax return that is proven to always have a positive impact on your life. Forbes.com’s Amy Modglin wrote, in 2020, about her journey investing herself saying, “in my experience, it will be the best investment you ever make.”

Pay off debts

It’s may not have the same instant endorphin hit as splurging on a new TV or beachside vacation but paying off your debts (particularly any high-interest debts) is a smart and savvy way to spend your tax return.

Getting yourself out from under credit card debt in particular is a great candidate for spending your tax return for a number of reasons. Credit cards typically have much higher interest rates than other types of loans – even “low-rate” credit cards average more than 13%.

Credit card companies are more than happy for their customers to make minimum payments on a debt and allow the interest to continue to build. Just paying off a chunk of a debt could save you thousands in interest.

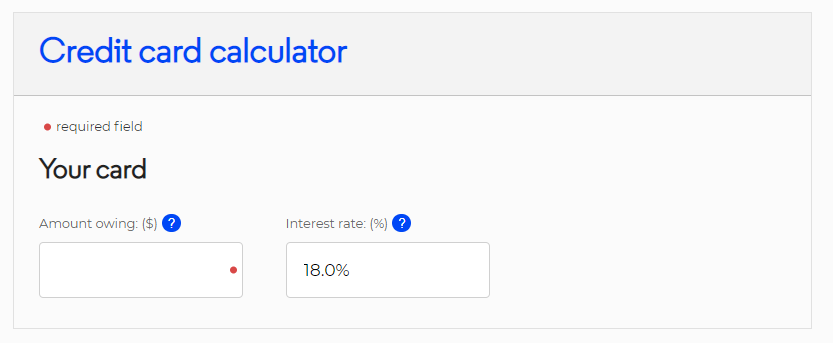

You can quickly calculate how long it will take to pay off your card by making minimum repayments and how much time and money you’ll save by making higher repayments by using this quick online calculator. Warning: you may be shocked by the results.

You can quickly calculate how long it will take to pay off your card by making minimum repayments and how much time and money you’ll save by making higher repayments by using this quick online calculator. Warning: you may be shocked by the results.

On top of the monetary benefits, getting out from under a debt is proven to hugely decrease stress and boost mental health. It’s hard to put a price on sleeping easier at night.

It could also strengthen your credit score – enabling better borrowing opportunities in the future – something that it invaluable to a growing small business.

Spend money to save money

When tax time comes around it’s often a last-minute scramble to consolidate any business purchases that can be claimed as a deduction. Start the process now and you could save yourself more money than you realise.

This is because the Australian Tax Office (ATO) says that any work-related purchase worth more than $300 depreciates over its ‘effective lifetime’. This depreciation builds over time and can be added to your tax return.

A smart tactic is to get a head start by making these $300+ purchases with your tax return – meaning by the time the next financial year rolls around the depreciation value has built up much more than if the item had been bought only recently.

If you have been holding off on a large business-related purchase for a while, consider using your tax return to fund it now. As the item depreciates slowly over its ‘effective lifetime’ (the length of which differs depending on the product) any depreciation can then be used as a deductible. If you had waited until the end of the financial year to make these kinds of purchases, you’d be looking at a much smaller deducible.

Just make sure you keep any receipts and work with your accountant to calculate these kinds of deductions.

Get a healthier tax return by using our tax tips all year round.

Avoid nasty surprises at tax time and stay on top of your small business finances by using easy, affordable accounting software like Cashflow Manager. Cashflow Manager simplifies your expenses, cash-in, cash-out and invoicing.

Leave a Reply