Take control of your cash flow

Unlock your cash flow and make better business decisions

What is cash flow management?

Cash flow management is all about tracking how much money is coming in and going out of your business, and when.

If you’re doing it right, understanding your cash flow takes the guesswork out of running a business – allowing you to budget and predict how much cash you will have in the short or long-term. It is a vital tool for any business that can influence every aspect of running a business.

Why is it important?

As a business owner, it is critical to know how much money you currently have – and will have in the future. Practicing good cash flow management gives you the information you need to make important spending decisions.

Without good cash flow management strategies – it’s very difficult to grow when to employ staff, pay suppliers, invest in infrastructure, grow your business and more.

How can I manage my cash flow?

One option is to prepare your own cash flow projection to map out your future cash flow. To help you get started, we have created a step-by-step guides on How to Create a Cash Flow Projection and Managing Cash Flow for Small Business.

Another option is to enlist the help of simple bookkeeping software, like Cashflow Manager. Read on for the benefits Cashflow Manager can bring to your cash flow.

Quick and easy set-up

Cash flow strategy

Get paid on time

Relax about your BAS

More accurate than a crystal ball

Running a small business can often feel unpredictable – as though you’re dodging financial pitfalls hidden around every corner. Cashflow Manager’s intuitive accounting software lets you take back control.

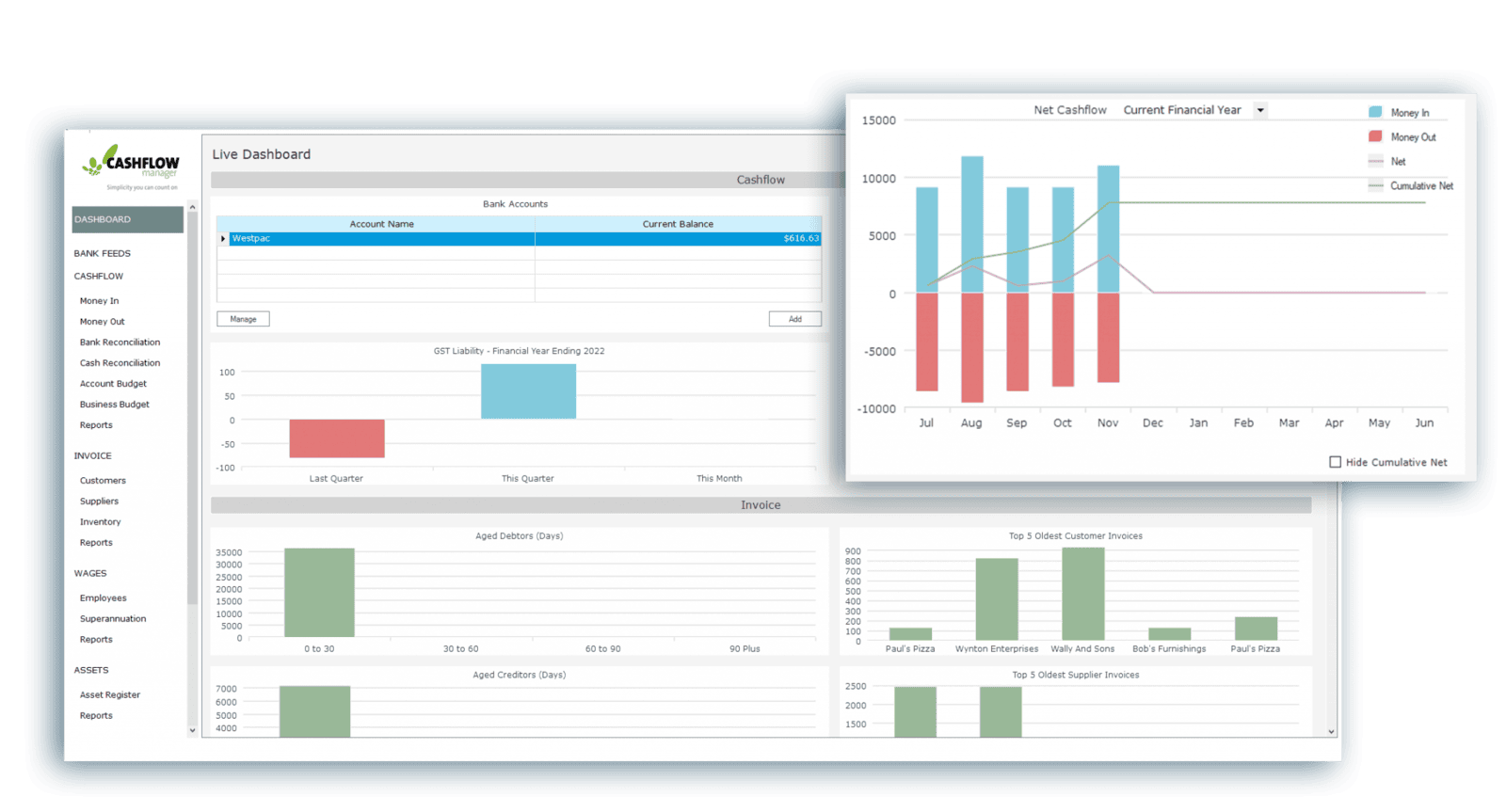

- Map out your income and expenses on an easy-to-understand, yet powerful dashboard

- Rid yourself of nasty gaps in your cash flow by automatically highlighting outstanding unpaid invoices

We'll do the work for you

Time is precious.

Small business budgeting and cash flow management doesn’t have to involve being hunched over a desk, analysing your sales numbers. Instead, throw away the calculator and let Cashflow Manager crunch the numbers for you.

Cashflow Manager can create Cash Flow Reports in just a few clicks. Make better business decisions with dozens of reports at your fingertips.

Unclog your cash flow

Say goodbye to time consuming, manual data entry.

Use Bank Feeds* to connect your bank directly to your accounting software and watch safely and securely imports your transactions. Bank Feeds* cuts down on costly errors and makes bank reconciliation easy.

*Bank Feeds is available for $5 a month with Cashflow Manager and Cashflow Manager Gold subscriptions.

Get paid on time

Late payers got you down? Create, send, and track an unlimited number of invoices with Cashflow Manager’s built-in invoicing software.

Cashflow Manager will automatically monitor any late payers – so you can avoid those unpleasant interruptions to your cash flow.

Australia-based Customer Support

Our Customer Engagement Team understands the needs of Australian small and micro businesses.

We’re here to help you through every step of your business journey via phone, email, and chat support. Plus, if you are the kind of person who likes to find the answer yourself, our extensive Knowledge Base is filled with step-by-step guides, videos and tips.

Enjoy the simplicity of Cashflow Manager

For small business just starting out, or growing businesses in need of payroll - we've got you covered.

Cashflow Manager

For smaller businesses that want simple bookkeeping.

$28

/ Per Month for min. 12 months

Best Value

Gold

For growing businesses who also need payroll.

$51

/ Per Month for min. 12 months

Everything included in Cashflow Manager, plus:

Wages 1-4

For small businesses who just need payroll.

$16

/ Per Month for min. 12 months

Wages Manager

For larger businesses who just need payroll.

$39

/ Per Month for min. 12 months

Everything included in Wages 1-4, plus:

Cashflow Manager

For smaller businesses that want simple bookkeeping.

$306

/ Annually and Save $30

Best Value

Gold

For growing businesses who also need payroll.

$553

/ Annually and Save $59

Everything included in Cashflow Manager, plus:

Wages 1-4

For small businesses who just need payroll.

$192

/ Annually

Wages Manager

For larger businesses who just need payroll.

$412

/ Annually and Save $56

Everything included in Wages 1-4, plus:

Or try Cashflow Manager for free

No Credit Card Required.

Please ensure you meet our system requirements to guarantee a seamless experience with Cashflow Manager software.

Mac users will need to install additional software.