Reporting Simpler BAS in Cashflow Manager

The Australian Tax Office (ATO) have simplified GST reporting for small business by reducing the amount of GST information required in Business Activity Statements (BAS).

From the 1st of July 2017, small businesses will be automatically transferred to Simpler BAS. There are no changes to the reporting frequency or how other taxes are reported on your BAS.

This means you only need to report the following GST information:

- G1 Total Sales

- 1A GST on Sales

- 1B GST on Purchases

How does this work in Cashflow Manager?

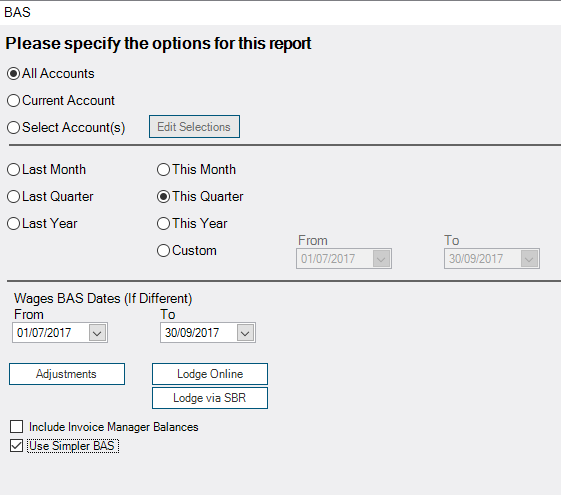

The BAS report in Cashflow Manager now includes a ‘Simpler BAS’ check-box. Simply tick this box to show a reduced amount of GST information.

Lodging your BAS online

The activity statement option in the ATO Business Portal menu is your starting point for lodging or revising most types of activity statements online. When you lodge online you will receive a receipt to confirm that your activity statement has been lodged and you can also view and print statements you have lodged previously.

From 1 July 2017, you will no longer need to re-enter your AUSkey or myGov credentials to declare that the information provided in your activity statement is true and correct – you just need to tick a declaration checkbox.

Download a free BAS guide for small businesses

Our quick guide to BAS includes much-needed information on:

- What exactly is a Business Activity Statement (BAS)?

- How to know if you need to lodge a BAS

- Understanding due dates

- Tips to make BAS lodgement easier

- Help submitting a BAS online

Comments (4)

Hi I am not very happy with Cashflow 11.5 I wish to go back to Cashflow 11 which i had before , is there a way of doing it ?

kind regards,

Liza

hi Rebecca,

What about the PAYG?

Regards, Jim

I have had nightmares since the change to BAS statements. I was not able to get an auskey which I have always used until this last one. The tax office sent me a hard copy of the BAS statement to forward in Jan-Mar and April to June. I was successful in forwarding my BAS statement July-September on time and lodged this one electronically as I get was able to get the auskey to work this quarter. Do I need to upgrade my cashflow manager and would it help.

Details V 10.0.2.1 Member No 7966

Hi Glenda, Thanks for your message. It’s my understanding that you need to be on at least Cashflow Manager V 10.5 due to some of the changes at the ATO’s end last year. It looks like you’re eligible to upgrade to v 11 if you wish! Hopefully this helps!

Kind Regards, Rebecca