single touch payroll

Report payroll information directly to the

What is Single Touch Payroll?

Single Touch Payroll (STP) has changed the way employers report payroll information to the Australian Tax Office (ATO). Previously employers reported this information to the ATO once a year, now, information is given to the ATO on each payday. These reports must be submitted using a software solution that is Single Touch Payroll compliant, such as payroll or accounting software.

Why do I have to use Single Touch Payroll?

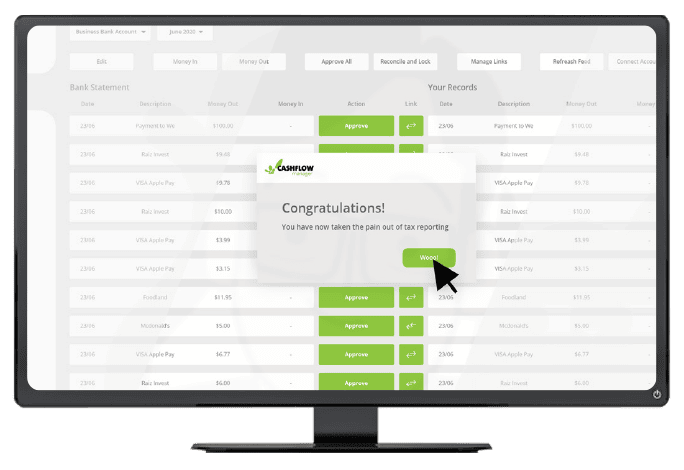

It is a legal requirement in Australia that all businesses report employee salaries, wages, PAYG withholdings and superannuation to the ATO through Single Touch Payroll. Adopting new technology and embracing a digital future can be stressful. But with Cashflow Manager’s payroll and accounting software, we make it simple and easy for you to stay compliant.

How do I stay compliant?

All of Cashflow Manager’s products are Single Touch Payroll compliant. So, if you’re already a Cashflow Manager subscriber, you’ll be able to complete STP by using our program. If you’re new to Cashflow Manager, you can get complaint and try our simple STP solution for your business with a free, 30 day trial. No credit card required.

What does Single Touch Payroll (STP) mean for small businesses and employers?

Before Single Touch Payroll (STP), employers reported their payroll information to the ATO through manual submissions – often just once a year. With STP, payroll information (including wages, superannuation and PAYG Withholding) must to be reported to the ATO every time you pay your employees – whether that’s weekly, fortnightly or monthly.

STP is a mandatory payroll reporting requirement, so you need software that’s STP compliant and makes meeting your payroll obligations easy. Luckily, there are affordable payroll software solutions available.

Single Touch Payroll Phase 2 explained:

STP Phase 2 will use the same STP system but require employers to input more detailed payroll information. This extra information will reduce the burden on employers who need to report to multiple government agencies. It will also improve how social support is administered.

Single Touch Payroll (STP) Key dates:

July 1, 2018: STP rolled out for businesses with 20 or more employees. STP rolled out for businesses with 20 or more employees.

July 1, 2019: Employers with 19 or fewer employees began using STP, with special concessions depending on business, industry, or employer types. Employers with 19 or fewer employees began using STP, with special concessions depending on business, industry, or employer types.

July 1, 2021: Concessions for certain businesses, industries or employer types ended. Concessions for certain businesses, industries or employer types ended.

January 1, 2022: STP Phase 2 reporting begins if you are not a Cashflow Manager subscriber or have not received a deferral. STP Phase 2 reporting begins if you are not a Cashflow Manager subscriber or have not received a deferral.

August 1, 2022: We will start rolling out STP2 features to Cashflow Manager customers We will start rolling out STP2 features to Cashflow Manager customers

Oct 31, 2022: STP2 rollout for Cashflow Manager customers finishes. STP2 rollout for Cashflow Manager customers finishes.

Single Touch Payroll Software for Small Business

Try out Wages 1 - 4: our simple, low-cost Single Touch Payroll software solution for businesses with up to four employees.

Need more than just payroll?

Enjoy simpler financial record-keeping, send invoices, pay your staff and automatically stay up-to-date with ATO reporting regulations with Cashflow Manager Gold.

Easy guide for current subscribers

If you are a Cashflow Manager subscriber and looking for support regarding Single Touch Payroll, we have a guide to take you through the process. Learn how to set up your STP reporting, how to lodge a pay event and how to complete your End of Financial Year Finalisation.

Click below for a full guide on using STP within our software.

Accessing JobKeeper payments through STP

JobKeeper Payments uses the Single Touch Payroll system, enabling businesses to submit their eligible employees to the ATO for salary reimbursement. The ATO will use this information to determine eligibility for JobKeeper payments.

Click below to read more information from the ATO on accessing Jobkeeper Payments through STP.

Automatically stay up-to-date

All our payroll software is ATO compliant. Be ready for STP Phase 2 just by subscribing to Cashflow Manager’s business payroll software. When and how you report will depend on what type of employer you are.

For more information on Single Touch Payroll, please click the button below for the ATO website.