Business Structure: The right one for your small business

One of the first major decisions to be made after deciding to chase the dream of starting your own business is selecting the right business structure. Yet, despite its importance, choosing a business structure that’s suited to your business’s needs and goals is a little-known and rarely discussed part of becoming a small business owner in Australia.

Try thinking of the business structure of your new venture as the foundation upon which your new business will be built.

Much like the foundation of a building, they may not be the most exciting or appealing part of the process – but, if you don’t get it right, you will undoubtedly run into trouble in the future.

In Australia, the business structure you choose will determine how much tax you pay, how much control you have over the business, the amount of paperwork, and much more. While you can change the business structure as your operation grows and expands, it’s vital that you choose the right one to avoid headaches and unnecessary expenses.

So, whether you’re starting a new business, or even re-evaluating your business’s current structure, our guide will shed some light on the common business structures, and which one may be best suited to you.

What exactly is a business structure?

The truth is, not all businesses are created equally.

A business structure is the legal framework within which your business will operate. Each one can drastically effect how your business is run and even how much money you take home at the end of the day. Your chosen business structure determines many things, including:

- the licenses you require

- your tax liabilities and how much tax you pay

- whether you’re considered an employee, or the owner of the business

- your responsibilities around superannuation

- potential personal liability (i.e., how at risk you are if things go pear-shaped)

- how much control you have over the business

- ongoing costs and volume of paperwork for your business

Every business structure is different and choosing the right one will depend on your business goals, your finances and your

Let’s quickly run through the most common business structures in Australia.

Business Structure Types – Pros and Cons

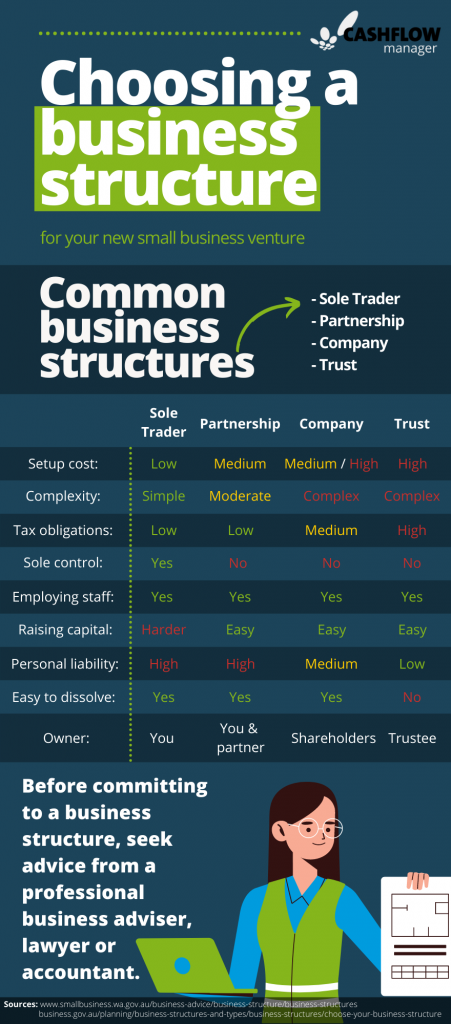

To help put all these in perspective and weigh the pros and cons of each type of business structure, here’s our helpful infographic comparing each one:

Sole Trader

This is in many ways the simplest form of business structure. It’s easier and least expensive to set up initially. A sole trader has a high amount of freedom when it comes to making decision in the business and capturing profit. Also, despite what the name suggests, you can even employ other people.

Sole Traders have the fewest tax reporting requirements and can even lodge their tax as part of their personal income tax return. However, you would need to register for goods and services tax (GST) if your annual turnover is expected to exceed $75,000.

BE AWARE: Sole traders tend to have what’s called ‘unlimited liability’ which means all your personal assets are at risk if things did go wrong. You’re also not entitled to workers compensation if you get hurt at work.

Partnership

A partnership is exactly what it sounds like – a number of people running a business together.

A partnership shares quite a few similarities to a sole trader in terms of the tax reporting obligations and ease of set-up.

One key concern with a partnership is the potential for disputes over profit sharing, administrative control, day-to-day involvement, and business direction.

Because of this, it is advised to have a lawyer prepare a formal agreement outlining:

- each partner’s role and level of authority

- each partner’s financial contribution

- a procedure for resolving disputes

- a procedure for ending or resigning from the partnership.

- the number of people or entities running a business together, but not as a company.

Company

A company is where we begin to create some separation between the business and the business owner. This has the benefit of allowing the company to accrue its own debt, profit, and associated risk separately from the owners (called shareholders).

This – quite literally – comes at a cost.

Companies have significant set-up and maintenance cost as well as complex tax reporting requirements.

Trust

Things get a little more complicated and abstract when it comes to a trust.

In a trust, a ‘trustee’ holds your business for the benefit of others (the named beneficiaries).

This ‘trustee’ can be a person or even a company, who decides how the business is run and how the profits should be distributed to the beneficiaries.

While trusts are expensive and complicated to set up, they are generally used to protect the business assets for beneficiaries (which can be families or even children).

Can I change my business structure?

The good news is you’re not locked into any business structure and you can make a switch as your business changes or grows.

The bad news is some changes are easier than others.

Example 1: Your partnership is going well, and you would like to open the door to more capital raising by shifting to a Company business structure. This would require you to dissolve your partnership and set up a separate company. You cannot simply transfer your partnership into a company.

Example 2: You’re a sole trader and you decide to bring in a passionate business partner to strengthen your operation. You cannot do this without applying for an entirely new Australian business number (ABN).

Once you understand the differences in these commonly used business structures, it’s essential that you talk to your tax, business and/or legal adviser.

After your business is up and running, avoid the pitfalls of accounting and bookkeeping by using simple, easy-to-use, accounting software Cashflow Manager. Start a 30-day free trial today.

Leave a Reply