What is eInvoicing? Electronic Invoicing in Australia explained

eInvoicing (or electronic invoicing) allows businesses to connect to a network and automatically create, send, and process invoices with other businesses on the network.

eInvoicing removes the manual work involved in processing an invoice and connects seamlessly with any system on the network. Because of this, eInvoices are a faster, safer, and more accurate way to invoice other businesses.

Getting paid for your work can be one of the most satisfying parts of running a business. Sending an invoice and receiving the money you have earned (often the culmination of hours, days, or weeks of hard work) feels good. So, when it doesn’t go smoothly, it’s like finding a bug swimming around in your favourite dessert.

eInvoicing promises to make invoicing easier, cheaper, quicker, less prone to errors, and more secure.

Read on to find out why the government, big businesses, and small businesses are all betting on eInvoicing as the future of business-to-business trading in Australia – and find out how you can start benefiting from the technology.

What are eInvoices (electronic invoices)?

At a glance, eInvoices may appear like normal invoices – but don’t be fooled, a lot is going on under the surface.

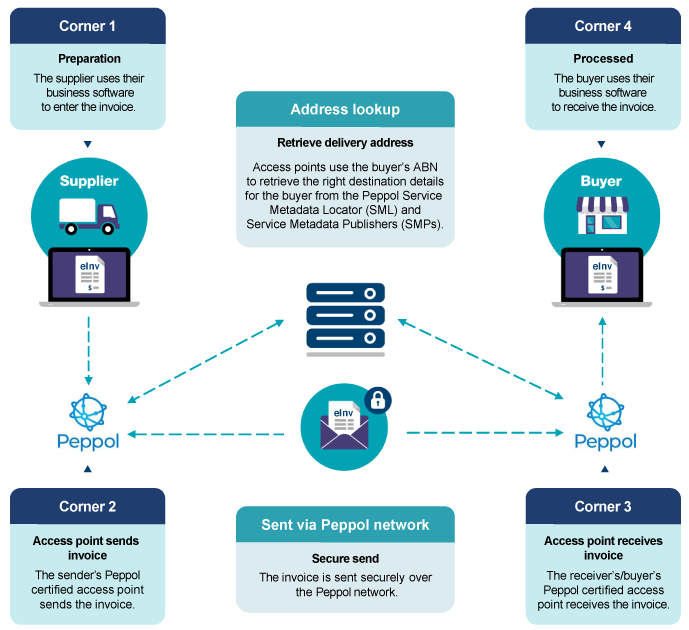

eInvoices are sent through something called the Peppol Network (but more on that later). The network’s job is to structure the invoice’s information in a way that allows any accounting software to read and process it automatically.

This has a raft of benefits, including removing the need to manually input or scan invoices, stopping invoices from being lost, and cutting down on a tonne of costs.

Note: eInvoicing is used between businesses (that is, suppliers and buyers) and cannot be used between businesses and their consumers.

How does eInvoicing (electronic invoicing) work in Australia?

In Australia, eInvoicing uses the Peppol Network to securely send invoice data between suppliers and buyers.

Businesses can simply sign up to an accounting software that is connected to the Peppol Network and they can send eInvoices to anyone else also on the network – regardless of which accounting software they use.

Australian Peppol Network and e-Invoicing explained:

The Peppol Network works its magic by standardising invoice data.

Essentially, this means that all accounting software using the Peppol network agrees to recognise the same data structure on their invoices. So, as long as you’re on the Peppol Network, you’re all set.

Accounting software that is connected to the Peppol Network will then instantly read an eInvoice and enter its details into your system – ready to categorise the invoice, request payment, update your cash flow, and save it for when tax time comes around.

The ATO and eInvoicing explained:

While the Peppol Network is an international standard, in Australia the ATO runs the Peppol Authority, which is responsible for making sure the network works correctly for all Australian businesses that use eInvoicing. This includes things like making sure that eInvoices support the correct GST rate.

Note: This does not mean the ATO can view any of your eInvoices.

How are eInvoices different from emailed invoices?

Nowadays, most invoices are already sent electronically through email. However, don’t get it twisted, emailed PDFs are not eInvoices.

What makes eInvoices different from PDF files is that eInvoices, unlike regular invoices, can change to suit any system or software. While a PDF has a static layout that needs to be input into accounting software (be that manually typed in or scanned in), eInvoices are sent from the supplier’s accounting software, checked for errors by the Peppol Network, and then automatically logged into the buyer’s accounting software – ready for finalisation or processing.

Because of this, eInvoicing cuts out almost all manual data entry; saving you time, money, and the stress of avoiding errors or scams. eInvoices, unlike traditional invoices, also scale seamlessly with your business systems (e.g., cash flow or inventory).

Benefits of e-Invoicing:

Cost savings

According to the ATO, eInvoices cost less than half as much to process as paper and emailed PDF invoices. They found that paper and emailed PDF invoices generally cost between $27 and $30 to process, while eInvoicing costs less than $10 an invoice. That adds up to a significant saving, even for small businesses.

e-Invoices save you money by cutting down on the cost of:

- creating paper or PDF invoices to print, post, or email

- scanning and manually entering invoices into software

- printing, paper, and physical delivery

As you can see, eInvoices save money by removing both the material cost of the invoice as well as cutting down on the labour cost of categorising, entering the invoice, fixing any mistakes, and locating it when tax time arrives.

Time savings

By deleting the manual data entry involved in invoicing, eInvoices can boast obvious time-saving benefits.

This is particularly beneficial for sole traders and small businesses where the business owner manages the business finances. Less time spent entering, scanning, or hunting down invoices gives small business owners more time to focus on running their business the way they want to.

Fewer mistakes and errors

The Peppol Network has got your back and works hard to avoid mistakes on invoices.

eInvoices are checked for errors before they can even be sent, meaning you can say goodbye to missing information, smudged pages, unclear wording, or confusing item numbers.

While you still need to apply your internal checks before paying your invoices, you will never have to re-type or scan eInvoices, make corrections, or find out missing information.

Nothing gets lost

There’s are few things worse than losing an invoice (and, God forbid, not getting paid for your hard work!). Well, this isn’t an issue with eInvoicing.

eInvoices will never go to your spam folder, they won’t get lost at the post office, and a stray letter in an email address won’t send them awry.

All eInvoices are sent from one accounting software, via the Peppol Network, to the other accounting software. The internal checks that eInvoicing does mean that your invoices go to the right person every time and on time.

Secure invoicing that’s protected from scams

All eInvoices are transferred through the Peppol Network by using ABNs to choose the buyer or supplier.

The ABN look-up system ensures that your money is going to the registered business you want it to. This hugely lowers the risk of fake invoices, scams, and ransomware attacks compared with posted or emailed invoices.

Plus, despite their automation, eInvoices still give you complete control over processing your invoices. You can verify or approve invoices from your software.

Connect once and invoice anyone on the network

Once you have connected to the Peppol Network you can start invoicing anyone on the network regardless of their size or the type of accounting software they use.

Public sector organisations are using the Peppol network to allow other businesses to trade with them more easily. In fact, according to the ATO, federal government agencies are already benefiting from the speed of eInvoices, with eligible eInvoices being paid within five days.

Gather better business information

One of the biggest benefits of eInvoicing is its ability to seamlessly integrate with your business software. Once you receive or send eInvoices, they will be entered into any Peppol Network-enabled software – updating your cash flow without double-handling.

With instant access to more up-to-date information and less time wasted calculating your money paid and money owed, business owners can use eInvoicing to make better business decisions based on more accurate information.

Future Growth of eInvoicing:

The main limiting factor in eInvoicing is that it requires both the buyer and the supplier to be on the Peppol Network. However, once they are on the network – they can seamlessly trade with anyone on the network. As more and more businesses start using eInvoicing and connecting to the Peppol Network, the idea is that the benefits of the system will grow and grow.

In fact, the Australian Government is so confident about the potential economic and efficiency benefits of eInvoicing that they are spending big money to increase adoption rates. Since 2020, the federal government has spent almost $19 million to encourage eInvoice adoption, enhance the value of eInvoicing for businesses, and improve business awareness.

Leave a Reply